Income Tax Department Alerted 21 Lakh Taxpayers – Did You Receive the SMS? Take Action Immediately

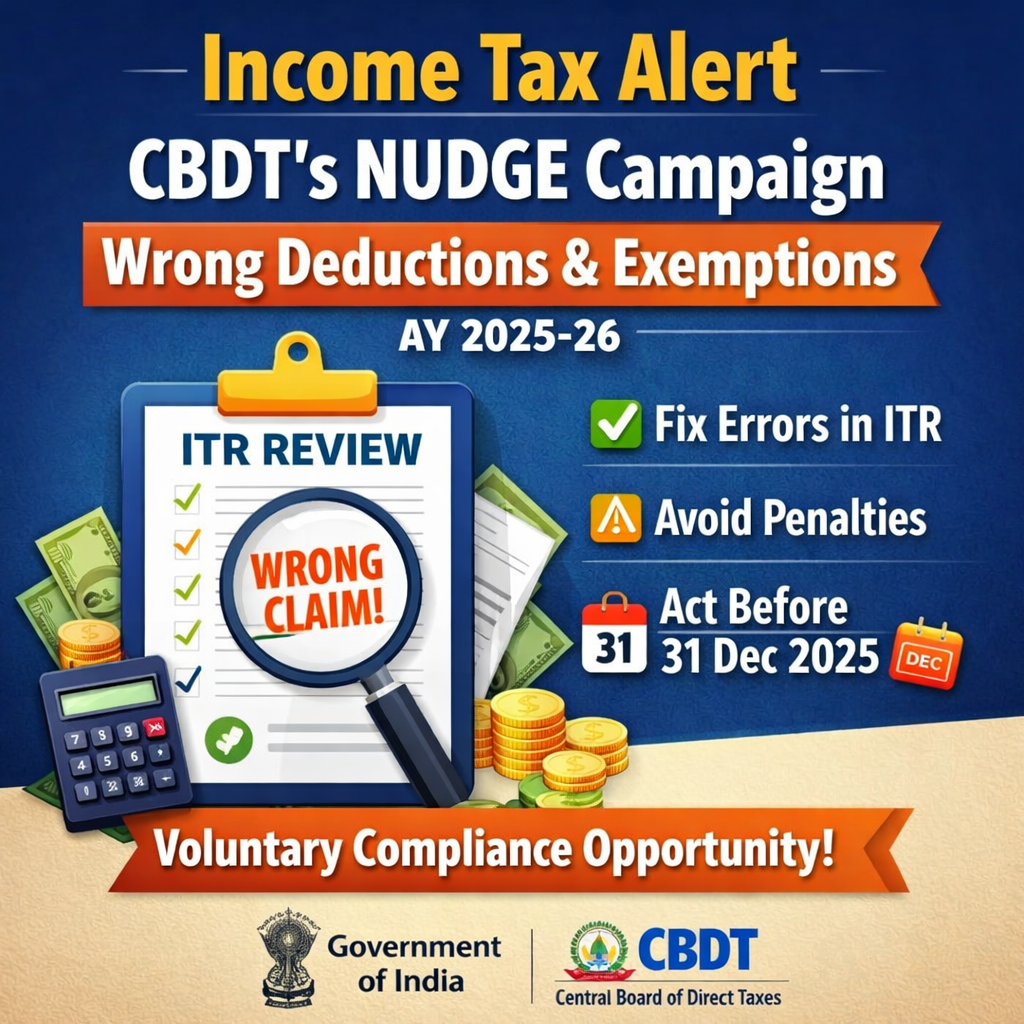

Income Tax Alert: CBDT Launches NUDGE Campaign Against Incorrect Deductions & Exemptions (AY 2025-26)

Government of India | Ministry of Finance | Central Board of Direct Taxes

Press Release | 23 December 2025

The Central Board of Direct Taxes (CBDT) has released a significant advisory calling upon taxpayers to review their Income Tax Returns (ITRs) for Assessment Year 2025-26 and voluntarily rectify any incorrect claims of deductions or exemptions.

This action is part of the Government’s “NUDGE” Campaign (Non-intrusive Usage of Data to Guide and Enable), which focuses on encouraging voluntary tax compliance by using data analytics—without resorting to coercive or intrusive measures.

What Prompted This Action by CBDT?

Using advanced data analytics and risk management tools, the CBDT has detected several instances where taxpayers have made incorrect claims in their Income Tax Returns. These include cases where taxpayers have:

-

Claimed deductions or exemptions that are not legally admissible

-

Reported bogus or questionable donations, particularly to:

-

Registered Unrecognised Political Parties (RUPPs)

-

-

Quoted incorrect or invalid PAN details of donation recipients

-

Claimed deductions in excess of prescribed limits

-

Incorrectly disclosed exempt income amounts in their ITRs

Such inaccuracies lead to under-reporting of taxable income, making these returns prone to scrutiny.

📩 How Are Taxpayers Being Notified?

Taxpayers identified through this exercise are being informed through:

-

SMS

-

Email

These messages advise taxpayers to:

-

Review their already-filed ITRs

-

Voluntarily correct any errors, if found

⚠️ Important Clarification

This communication is not a statutory notice under the Income Tax Act.

It is an early compliance alert, giving taxpayers a chance to self-correct.

⏰ Deadline to Take Corrective Action

👉 31 December 2025

Before this date, taxpayers may:

-

File a Revised Return, or

-

Submit an Updated Return, wherever permitted

Timely correction can help avoid:

-

Further verification or scrutiny

-

Formal notices

-

Penalties or additional proceedings

📊 CBDT Data Shows Strong Voluntary Compliance

The CBDT has highlighted encouraging results from this approach:

-

Over 21 lakh taxpayers have already:

-

Updated their returns for AYs 2021-22 to 2024-25

-

Paid more than ₹2,500 crore in additional taxes

-

-

For AY 2025-26 alone, more than 15 lakh revised returns have been filed

These figures demonstrate that voluntary compliance is more effective than coercive enforcement.

✅ What Should Taxpayers Do Now?

Step-by-Step Guidance:

-

Review your ITR carefully, especially:

-

Chapter VI-A deductions (Sections 80C, 80G, etc.)

-

Exempt income disclosures

-

-

Verify supporting documents, such as:

-

Donation receipts

-

PAN details of donees

-

Eligibility criteria for exemptions

-

-

If any discrepancy is found:

-

File a Revised or Updated Return

-

-

If all claims are accurate and genuine:

-

No further action is required

-

❌ Who Does Not Need to Worry?

The CBDT has clearly assured that:

Taxpayers who have correctly claimed legitimate deductions and exemptions need not take any action.

Honest taxpayers remain fully safeguarded under this initiative.

📅 What Happens If This Opportunity Is Ignored?

-

Taxpayers may still file an Updated Return from 1 January 2026

-

However:

-

Additional tax liability will arise

-

The risk of future inquiries or assessments increases

-

🧠 Key Takeaway

The NUDGE Campaign reflects the government’s:

-

Trust-based, taxpayer-friendly approach

-

Emphasis on voluntary compliance

-

Strategic use of technology and data, instead of harassment